Learn first the Ins and Outs of Online Personal Loans

Going down to the bank and waiting in long lineups to have your loan application accepted might seem incredibly monotonous and tiring when you're already swamped with your hectic schedule at the office and handling chores at home and other day-to-day activities. More importantly, you don't even get a say in the matter at times of crisis. A quick online personal loan might help in such a situation.

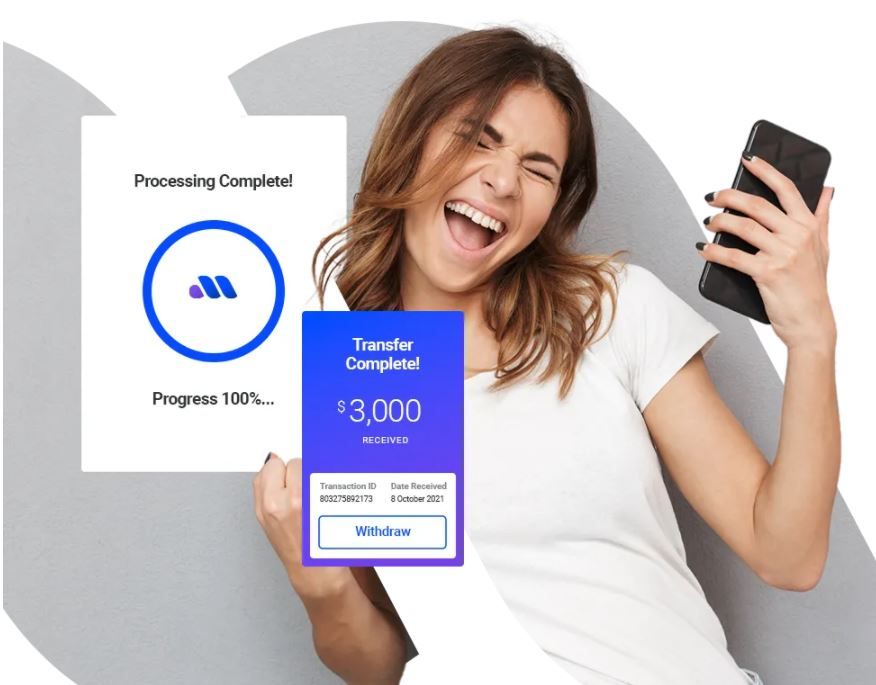

When you acquire instant loans, you may fill out your application whenever and wherever you choose. The good news doesn't end there, though; if authorized, the loan money will be sent into your bank account within 24 hours. As a result, many people who need money quickly are turning to immediate personal loans online. The advancement of technology has also made it possible to apply for loans online, eliminating the need to leave the house.

Learn about the benefits of personal loans, the paperwork needed, and the process for obtaining a personal loan online quickly by reading this article.

To Begin, Let's Define a Quick Personal Loan

A quick personal loan is simply a way to get access to cash while you're struggling to make ends meet. A personal loan approved in an hour can only be used once. Therefore, they are not spread out over a very lengthy time frame. Online lenders are the most common source for this type of loan. People who need cash quickly for things like emergency medical bills, auto repairs, or debt consolidation may find these loans appealing. It's a great option for getting cash quickly because you don't have to wait weeks for a loan application to be granted.

Advantages of a Quick Internet Loan

There's usually a good explanation why individuals adopt a new practice. People choose rapid personal loans online because they may get the money they need quickly and without leaving the comfort of their own homes. Here are some advantages of immediate personal loans online that attract borrowers.

· Standardized little paperwork

· Multiple Repayment Options

· The loan amount is approved and disbursed quickly

· Required Paperwork for a Quick Personal Loan

· To update your application, please provide the necessary identification papers.

· Proof of Permanent Resident Status Document

· Paystubs from the past three months

If you're interested in learning more about loans for any purpose

Download the app: automotive loans, home improvement loans, student loan applications, and so on are all readily available. The market is flooded with loan-specific applications.Register by filling out some standard loan and personal details. Your name, address, and other personal details are required to complete the application.

Click the "Request Loan" option within the instant cash loan app afterward to submit your loan request. As a further stage, you'll need to prove who you are. Borrowers are typically required to provide identification to verify their status. Some of your legal paperwork will need to be uploaded. Signing this document confirms that the details supplied are correct and the loan proceeds will be sent into your bank account shortly after.

Conclusion

Now that you know more about the benefits of receiving a rapid personal loan online, you'll be more prepared the next time you need to borrow money quickly or come across someone in a similar situation.

Comments

Post a Comment